The Ultimate Making Tax Digital Guide for Beauty, Hair and Wellness Businesses

What does Making Tax Digital mean for my business? The Making Tax Digital (MTD) programme means that from April 2019 UK businesses earning over £85k will need to submit digital tax returns.

The MTD national rollout is designed to make tax administration easier and more efficient:

- Save time on tax admin

- Reduce reporting errors

- Lower risk of penalties

Navigating tax compliance and the new MTD guidelines can feel confusing and time-consuming. This guide will explain everything you need to know about MTD, so you can nail your tax obligations, and get back to what you really want to be doing (we’re guessing tax administration isn’t top of the list)!

Who’s affected by Making Tax Digital?

Let’s start with the turnover test. Making Tax Digital is a progressive rollout beginning with VAT in April 2019. The first businesses to be affected will:

- be VAT registered

- have a taxable turnover above £85k per year

Even if your turnover drops below the HMRC VAT threshold, you will still need to continue digital bookkeeping.

If you’re still not sure, check out this handy MTD guide from the UK Government. This will let you know if you need to sign your business up for the Making Tax Digital for VAT.

But I think my business is exempt from Making Tax Digital

There are a few situations where businesses are exempt from MTD. If it’s not reasonably practicable for you to use digital tools to maintain your tax administration or submit VAT returns, you could be eligible for an exemption. The factors considered include:

- your age

- a disability

- if your business is located remotely

- whether you or your business are subject to an insolvency procedure

- if your business is run by practicing members of a religious society or order whose beliefs are incompatible with using electronic communications or keeping electronic records

If you’re already exempt from filing VAT returns online, or if your business has an annual turnover below £85k, remember you don’t need to sign up for MTD or apply for an exemption.

Applying for exemption through the HMRC is easy — simply call or email the general enquiries division of VAT, making sure to supply:

- your VAT Registration Number

- your business name and location of your business

- the reason for your exemption request

- details about your current VAT return filing systems

- any reasons why you would not be able to file returns digitally

- any other reason why you cannot follow the MTD rules

One important thing to note is whether your business has variable turnover — if your taxable turnover drops below the VAT registration threshold at any point after 1 April 2019 you’ll still need to continue your digital bookkeeping.

When does Making Tax Digital for VAT start?

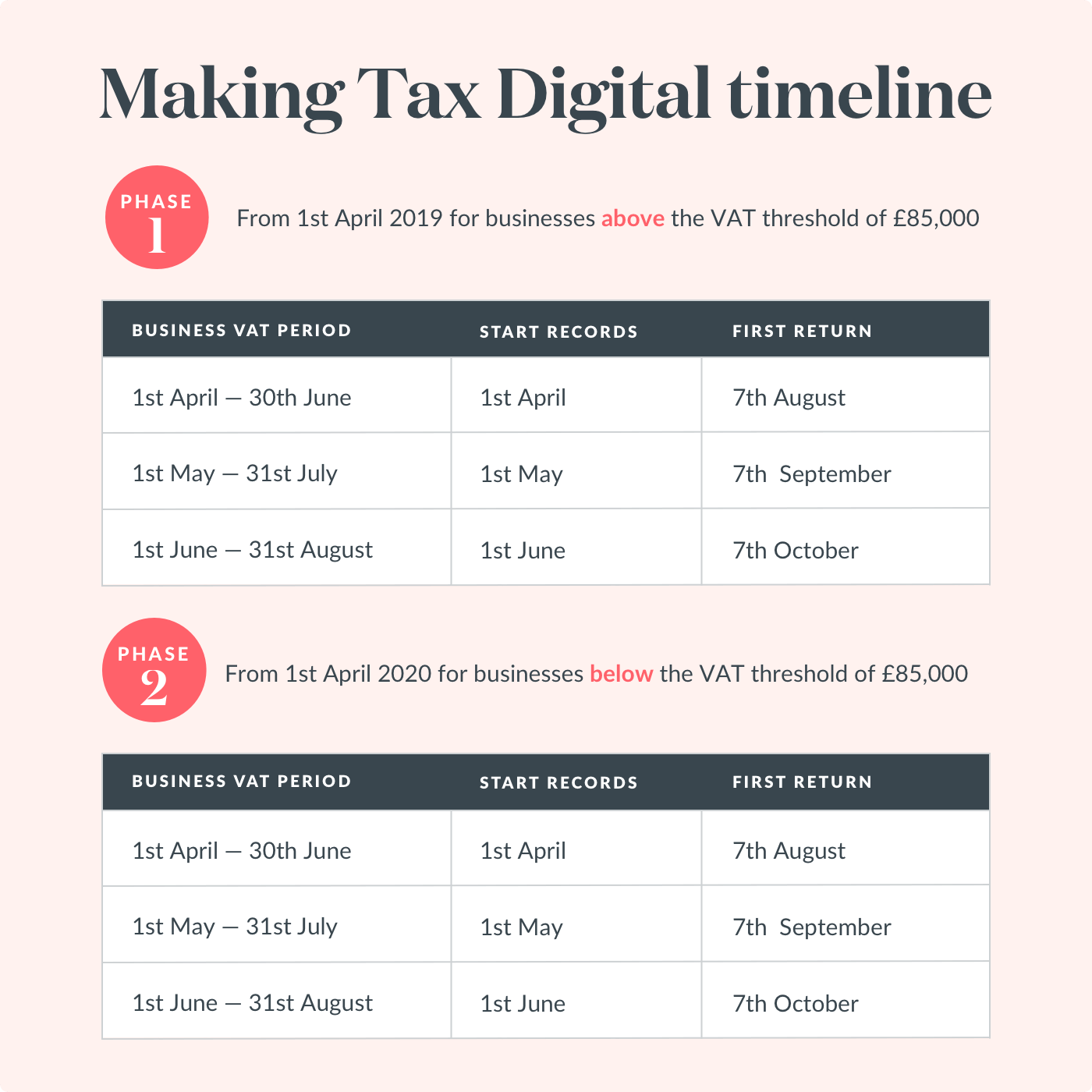

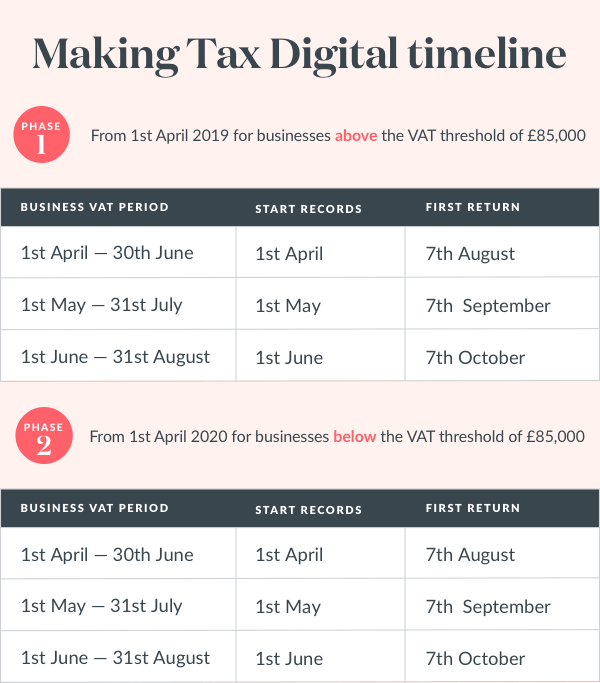

Being a progressive rollout, Making Tax Digital has some key dates you’ll need to make note of in your calendar.

The first is April 1 2019 — after this point, all VAT tax returns will need to be submitted digitally via the HMRC gateway.

We’ve put together a handy making tax digital timetable, to make sure you don’t miss a bookkeeping beat:

Signing up to Making Tax Digital

There are three things you’ll need to sign up for Making Tax Digital for VAT.

- Compatible software to submit your VAT return (more on this below!)

- Information about your business, or the business you’re signing up

- A Government Gateway ID number and password

Great, I’m signed up – how do I keep digital records?

HMRC rules state that under the new MTD scheme, you’ll need to keep digital records of the following:

- Business name and contact details

- VAT number & scheme used

- Adjustments

- VAT on supplies made & received

- Time of supply or receipt

- Net value (excluding VAT)

- Rate of VAT charged or that you will claim back

- Daily Gross Takings (DGT) – retail scheme users only

- Value of sales made under Gold Accounting Scheme (if applicable)

- Total output tax on purchases under Gold Accounting Scheme

A spreadsheet is sufficient for recording and preserving your VAT records – but you’ll still need to link it with other software in order to file your return with HMRC. If you’d rather make life easier and do all your bookkeeping in one place, we recommend using HMRC-recognised software.

What is HMRC-recognised software and where can I get it?

The HMRC has a list of software programs that are compatible with the new Making Tax Digital rollout. You’ll want a solution that is simple, fast and compliant. HMRC-recognised software should:

- record your finances digitally

- link your business and VAT information to all your transactions

- calculate the VAT you owe, and remind you when your VAT return is due

- supply your VAT data directly to HMRC

Signing up with a Timely-integrative software provider like Xero or QuickBooks will ensure you’re doing the right thing from the start.

The HMRC has put together a database of MTD – compatible software – and our friends at Xero and Quickbooks have the tick of approval!

Bookkeeping or Bridging?

The best MTD software solution for you depends on your existing business processes. Have you been manually managing your tax via spreadsheets, or do you already have an accounting software?

For example, a business that makes use of very little technology may want to consider spreadsheet bridging software – an application that can extract the contents of a spreadsheet and upload it to HMRC. Both Xero and Quickbooks have developed bridging software options, which can import data from spreadsheets into the Quickbooks or Xero interface, and then submit a VAT return to the HMRC.

Organisations that already use an accounting software will need to ensure that their software supplier is MTD compliant.

Shifting to a complete bookkeeping solution, like Xero or QuickBooks is a good option if you want to keep your tax administration as streamlined as possible. Using a full-package software solution has a number of benefits:

- Digital bookkeeping decreases the chance of making costly mistakes. Optimise your digital bookkeeping software by creating a Making Tax Digital schedule, to alert you when returns are due – this will ensure your VAT is always accurate

- Efficient, accurate bookkeeping on an easy-to-use digital platform saves you and your business time

Let’s look at a couple of software options you can use and how they work together with Timely to make your MTD journey as smooth as possible:

The first program is Xero. Timely seamlessly integrates with Xero to manage your invoices, track payments, and map sales accounts. When you connect Xero to your Timely account, we’ll automatically make sure your Timely invoices and any associated payments, are synced across to your Xero account, so you only have to enter your sales information in one place – perfect for business owners who want their business software to play nicely with their accounting software!

Another option is QuickBooks. When you complete an appointment, send invoices to QuickBooks. You can pull key information between the two platforms, like your tax rates, as well as sync your Timely-held client information with QuickBooks when you create an invoice.

Great! How do I get started?

There’s one more thing we need to cover. It’s an easy compliance checklist because there are consequences if you’re not MTD complaint. There are already serious implications for not submitting your VAT returns on time, so this shouldn’t be anything new.

MTD penalties will be based on a points system. Points will be given for each report or payment that is late. Once points exceed a threshold, a penalty will be charged for all subsequently missed deadlines.

HMRC have confirmed that no actual fines for MTD non-compliance will be levied in the first year if the business has made reasonable efforts to comply.

Making Tax Digital: a Compliance Checklist

- Make sure you’ve got a Government Gateway ID with the correct details: your name, your date of birth, National Insurance number and email address. Don’t leave this one to the last minute!

- Check when your first MTD submission is due. If you have grounds to believe your business is exempt, ring the VAT helpline to check.

- Work out exactly how you’ll record your transactions — Xero? QuickBooks? Another digital software platform? Bridging software?

The MTD scheme is the perfect opportunity to make your whole business digital, from booking client appointments, right through to bookkeeping.

Got the accounting software, but want to streamline your other business processes? If you haven’t already, sign up for a free trial with Timely, completely free! No credit card required. No obligations or fixed-term contracts.

Already using Timely, but want to make sure you’re MTD compliant? Check out our Xero or Quickbooks set up guides.