Could you be in trouble with the insurance police?

It’s a bit of a click-baity title, we’ll admit. But stay with us because we do have some important info about the cover you must have when you’re an employer…

We’ve put this article together with the help of our preferred UK insurance partner, Superscript.

It’s not something that hits the news, but if you google: business fined for not having employers’ liability insurance, you’ll see that it does happen. And it can cost a business. Big time.

Read enough already and keen to get the ball rolling on a new insurance policy? Then here’s an exclusive offer for Timely customers from Superscript.

Get 2 months’ free cover

Timely customers in the UK get 2 months free when they take out a new insurance policy with Superscript.

Terms and conditions apply*

Now, back to the question, if you have employees but don’t have employers’ liability insurance, there’s a chance you’re breaking the law and could be fined. Employers’ liability insurance is a legal requirement if you have any employees – whether they’re temporary, part time or full time. The exception being if they’re your close family members (check gov.uk for details on this).

What’s the point of employers’ liability insurance?

Employers’ liability insurance is designed to protect businesses from injury claims against them by employees.

“Why would an employee make a claim against the salon?”, you may ask. Electrical equipment, sharp tools and water. All commonplace in a salon environment and a Pandora’s Box of potential for injuries – from those that can be patched up with a plaster, to serious incidents which could put an employee out of work.

What if my salon has employees but I don’t have employers’ liability insurance?

It’s really important that you get this sorted. You can be fined £2,500 for every day you’re not insured.

Once you do have it, be sure to display your employers’ liability certificate as not doing so (or being unable to show it) can lead to a fine of £1,000 if inspectors ask to see it.

Employers’ liability claim example

Jo, your most popular hairdresser, who’s been working at your salon for 12 years, comes into work one day and accidentally trips on a loose cable while cutting a client’s hair. Her wrist is badly injured and she’s going to be unable to work for at least a couple of months.

While Jo’s unable to work during this period, she needs to be able to support herself and her family financially. She won’t be bringing income to the salon, so your business is going to be at a loss financially too.

If you have employers’ liability insurance, Jo will be able to make a claim without feeling that she’s putting the salon’s future at risk. If successful, your insurance provider will agree to pay out compensation to Jo so that she can stay afloat while she’s off work – leaving you without a huge financial loss on top of the impact of losing your most popular team member for a few months.

If you don’t have employers’ liability insurance, the salon may have to pay out compensation to Jo, which would be a potentially considerable unexpected expense for the business. Not to mention, you’d be breaking the law and could be fined £2,500 for every day you should have had it.

I don’t want it, or already have it

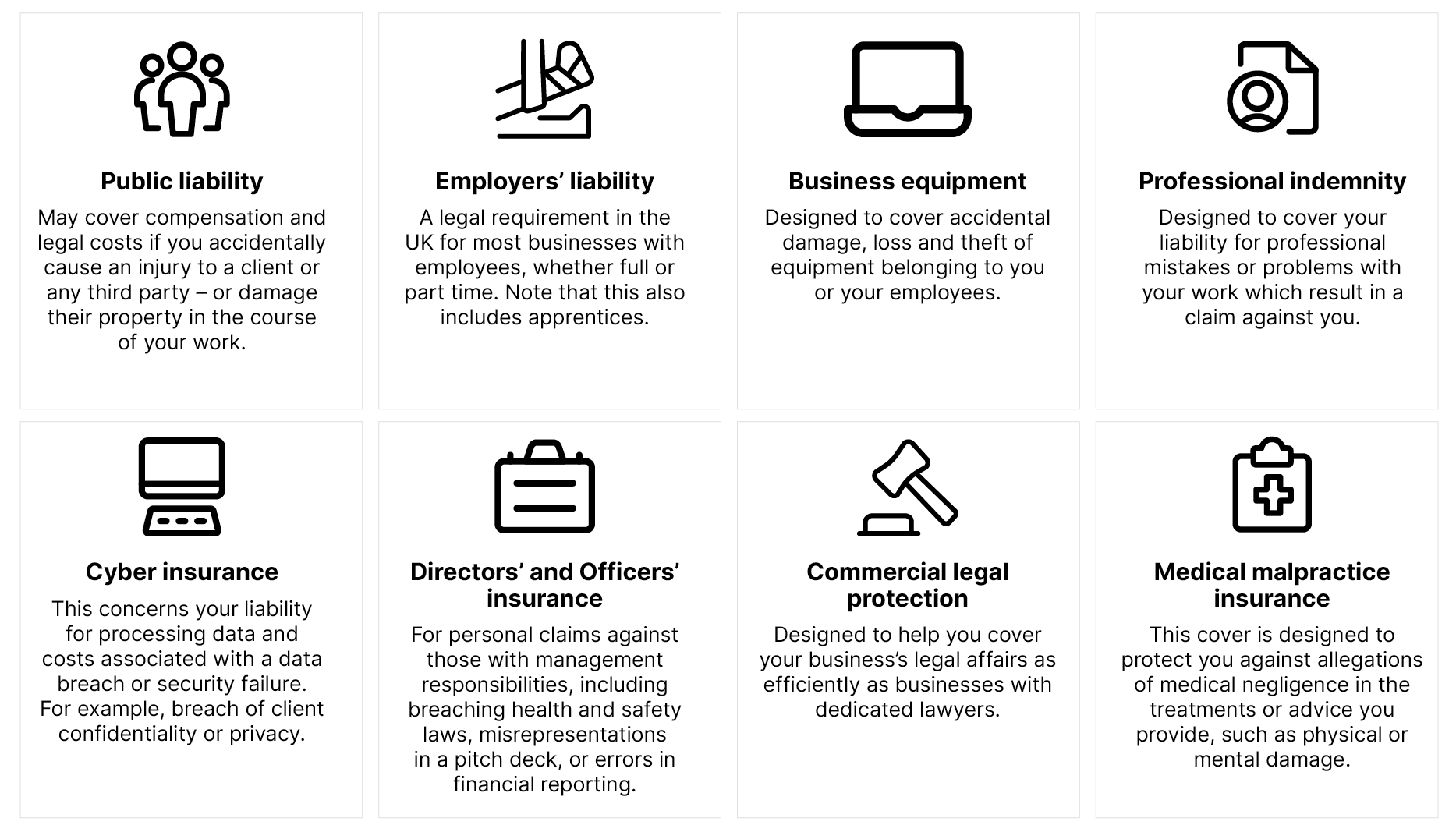

That’s great – but what about other covers? They’re not a legal requirement, but are something to consider.

Popular cover options for beauty and wellbeing businesses

Don’t forget, join Superscript and you’ll get their exclusive Timely UK offer – 2 months’ free cover for new customers.

Get a quote

Offer terms and conditions

2 months free” offer is available to any Timely customer taking out a new business policy online with Superscript; it will not be granted in conjunction with any other offer, voucher or discount, excluding unique referral codes from our Refer-A-Friend programme which can be used in conjunction with the Timely offer. The “2 months free” offer applies for 2 months only from the inception date of the initial policy. Subject to eligibility requirements.