Product Party: Next-level payments with TimelyPay

There are exciting updates coming to TimelyPay and now’s your chance to get the lowdown! We’ve been busy creating payment experiences your clients are going to love - you can now process their payment from the chair and they can leave with a receipt in their pocket! We’ve also got an early present for businesses that allows you to protect your revenue by requiring clients to save their cards and soon you’ll be able to charge for no-shows or late cancellations!

Cardless checkout

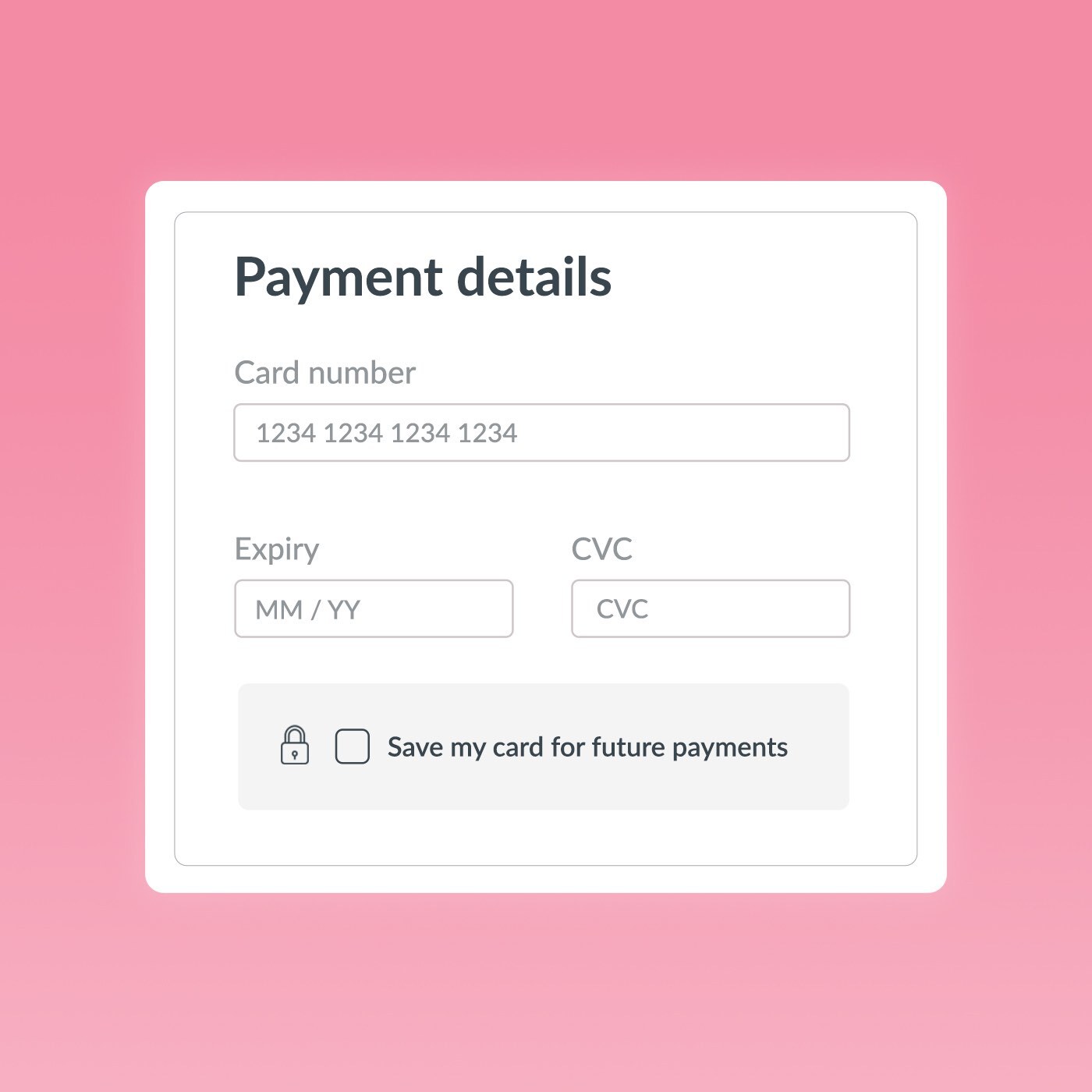

If you’re a TimelyPay user, you can now offer your clients the best payments experience! When a client stores their card you’ll now be able to charge that card in-store, just ask them “would you like to pay with your stored card” and you can take the payment while they’re sitting in the chair.

The client gets an amazing payment experience, you get to spend more time with them and your business stands out among the rest! No machines, no cards, no fuss. It’s the easiest way for clients to pay.

To unlock this, your clients need to save their cards. When clients pay online they have the option to save their card. You can also use a new feature called Card capture to require clients who book online to save a card. They’re more likely to show up and you can offer them the cardless checkout experience.

You’ll only find these new features available on TimelyPay. Don’t worry, it’s quick and easy to sign up, you can get completely set up or switch from PayPal or Stripe in under 10 minutes!

Help Guides:

Using cardless checkout

Setting up TimelyPay

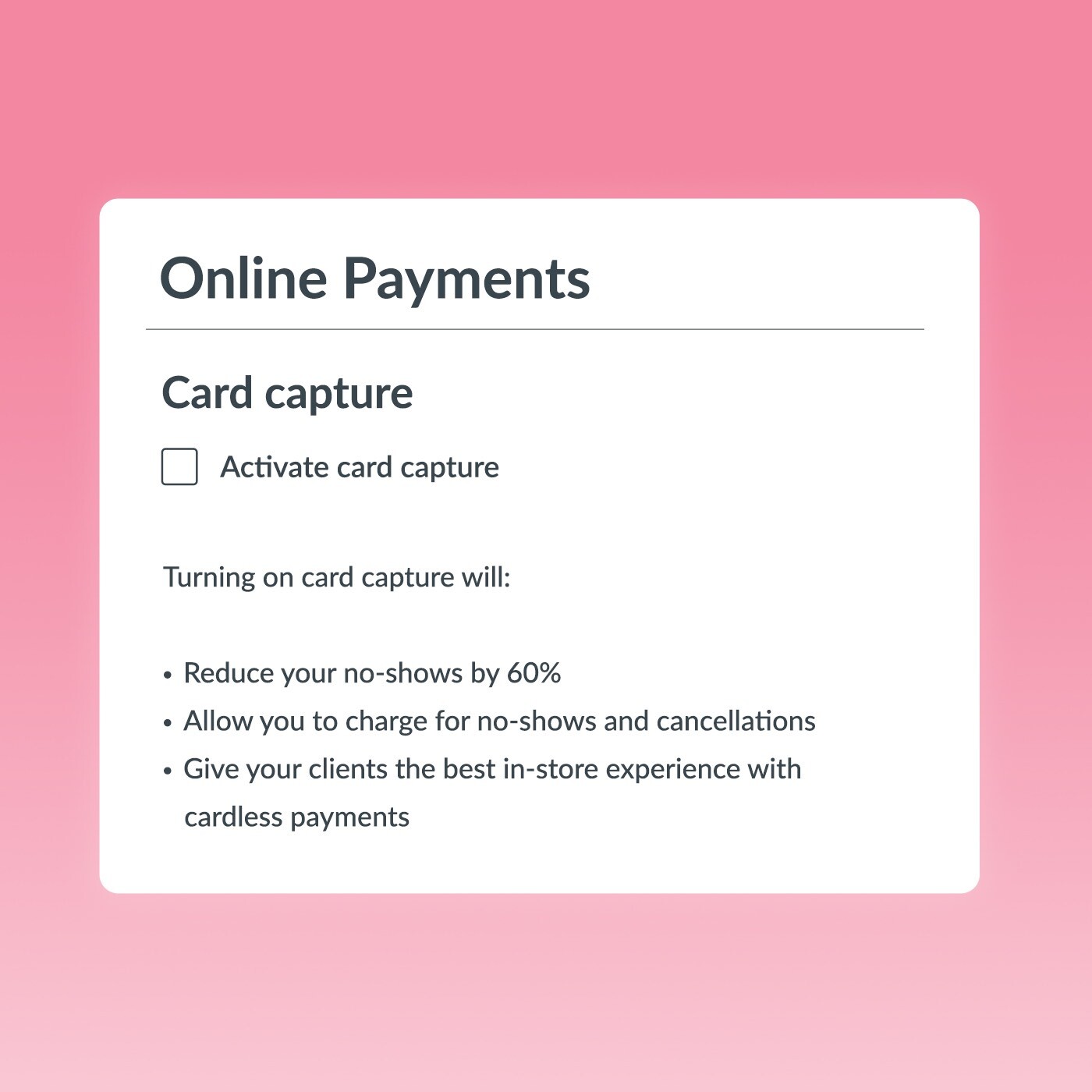

Card Capture

When card capture is enabled it means that a client will be prompted to log into Timely and save a credit card when they book with you online. This means more of your customers will be able to pay using cardless payment, but there are loads of other benefits for both you and your client!

Faster booking

Clients can enter their mobile and secure pin to bring up their client details and saved card, this means they’re more likely to complete their booking with everything already filled out.

Less no-shows

Not only does card capture enable the new no-show protection feature we’ll talk about below, but just getting clients to save their card reduces no-shows by 60%.

Easier online payments

If you’re taking deposits, selling vouchers online or sending out invoices, all your online payments get so much easier with card capture. Clients stored cards are ready and waiting for them next time they pay.

Less duplicate accounts

When clients log in to book their information is all there. This means they won’t use different details to accidentally create a new client record and extra work for you to clean up.

No show protection

As a part of card capture your clients will agree to updated terms and conditions, including agreeing that you can charge their card for future payments or cancelation fees.

This in itself works as a big deterrent for clients cancelling or no-showing appointments as they know you have their card information, but we’ll also be releasing a brand new no-show protection feature early in the new year! Check back here soon for more information on No-Show protection.

All these features are available on our Elevate and Innovate plans.